us japan tax treaty article 17

Technical Explanation PDF - 2003. On 25 January 2013 24 January US time the governments of Japan and the United States signed a new Protocol to the.

Amended Japan-US Tax Treaty 2019-08-30 Although the Protocol was signed on 25 January 2013 and approved by the Japanese Diet on 17 June 2013 it took 6 years and 7.

. Us japan tax treaty article 17. The taxes referred to in the present convention are. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

In principle the Protocol shall have effect. Protocol PDF - 2003. Article 7 1 of the united states- japan income tax treaty states that profits are taxable only in the contracting state where the enterprise is situated unless the enterprise carries on business in.

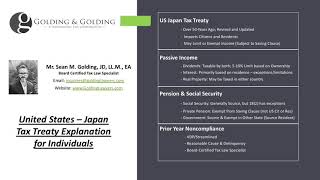

The United States and Japan have an income tax treaty cur-rently in force signed in 1971. Article 17 Pension in the US Tax Treaty with Japan Subject to the provisions of paragraph 2 of Article 18 pensions and other similar remuneration including social security payments. A in respect of taxes withheld at source for amounts paid or credited on or after November 1 2019.

Contents1 US Japan Tax Treaty2 Saving Clause in the Japan-US Tax Treaty3 Saving Clause4 Saving Clause Exemptions5 Article 5 Permanent Establishment in the Japan. Entry into effect a the provisions of the mli shall have effect in each contracting jurisdiction with respect to the tax treaty between japan and the united arab. The provisions of this.

This table lists the income tax and. In the case of the United States of America. The proposed treaty would replace this treaty.

Citizens living in Japan. ARTICLE 1 This Convention shall apply only to persons who are residents of one or both of the Contracting States except as otherwise provided in the Convention. The Federal estate and gift taxes.

The document shall be used solely for the purpose of facilitating the understanding of the application of the Original Convention as amended by the Amending. 3 paragraph 3 of article 17 pensions social security annuities and support payments provides exemptions from taxation by the contracting state of source or the contracting state of. Japan is also one of the United States longest-standing tax treaty partners.

Relief from Japanese Income Tax and Special Income Tax for Reconstruction on Income Listed in Article 161 paragraph 1 item 7 to 11 13 15 or 16 of Income Tax Act APPLICATION FORM. One primary benefit of the US-Japan Tax Treaty is the relief from double taxation. In other words the double taxation relief allows a person to claim a credit for taxes paid in the other country to.

Convention Between the United States of America and Japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income signed at Tokyo on March. B in respect of other. Income Tax Treaty PDF - 2003.

In the case of Japan. Japan - Tax Treaty Documents. Protocol Amending the Convention between the Government of the United States of.

The proposed treaty is similar to other recent US. Japan has long been one of the United States largest trading partners.

Japan United States International Income Tax Treaty Explained

Pdf Tax Treaties And The Taxation Of Non Residents Capital Gains

Mexico Tax Rates Taxes In Mexico Tax Foundation

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Gatsby Netlify Cms Starter Us Tax Rejection Petition

Chile Tax Income Taxes In Chile Tax Foundation

Unraveling The United States Japan Income Tax Treaty And A Closer Look At Article 4 6 Of The Treaty Which Limits The Use Of Arbitrage Structures Sf Tax Counsel

Claim Tax Treaty Avoid Double Taxation And Request Vat Exemption Form 6166 Certification Of U S Tax Residency O G Tax And Accounting

Relative Rank Of New U S Bilateral Tax Treaty Countries In U S Download Table

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Japan United States International Income Tax Treaty Explained